Enacted in the 2005 Energy Policy Act (EPACT) and Emergency Economic Stabilization Act of 2008, the Energy Efficient Commercial Buildings Deduction (Section 179D), Congress repealed and extended the tax credit. So if you or your business own, manage or lease a building for commercial or industrial use and are paying taxes on that property, you are likely entitled to a tax credit for every sq ft of your building for upgrading or installing your lighting to an energy efficient LED lighting system. You will want to claim the deduction for new construction and energy renovation projects.

Obvious benefits of an LED lighting retrofit or LED lighting upgrade project include:

● Reduce energy consumption

● Reduce your energy bills

● Reduce maintenance costs

● Improve office efficiency

Qualified Improvement Property (QIP) – 100% Bonus Depreciation & Section 179

LED lighting placed on nonresidential structures is also eligible for an immediate write-off utilizing either 100% reward depreciation or Section 179, as long as the lighting is placed after the structure is in service. This, in turn, enables companies to deduct the entire cost of eligible investments immediately, as opposed to doing so over a period of several years.

Bonus depreciation is scheduled to phase-out in calendar year 2023. The highest immediate deductions are:

● 80% for property placed in service in 2023

● 60% for property placed in service in 2024

● 40% for property placed in service in 2025

● 20% for property placed in service in 2026

Taxpayers were permitted a $1,050,000 immediate expense deduction for additions to qualifying assets, including improvement property, under § 179. The deduction is subject to a dollar-for-dollar phase out beginning when a taxpayer’s total qualifying purchases exceed $2,620,000.

179D: Energy Efficient Commercial Buildings Deduction

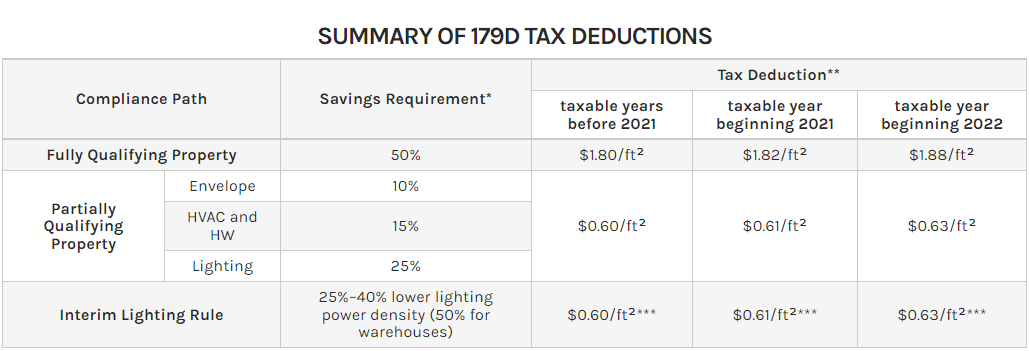

Sec. 179D is a widely used tax incentive that was recently made permanent as part of the 2021 Consolidated Appropriations Act. For example, upgraded interior or exterior lighting systems may be eligible to receive this tax deduction of as much as $0.60 per square foot. To qualify, you have to bring down the energy and power costs of a building by 25 percent. The owner of the building is eligible for the write-offs, except when the building is owned by the federal, state or local government. In that case, the company that designed the system may take the deduction.

Qualified Buildings Include:

● Commercial Buildings

● Warehouses

● Parking Garages

● Multifamily properties (with four stories or more)

● Government-Owned Buildings

● Public Universities

● Libraries

To qualify for the full deduction of $1.80-1.88 per square foot, energy and power expenses must be cut by 50%, benchmarked against the ASHRAE Standard 90.1-2007 (or 90.1-2001 for pre-2018 buildings or systems). Project costs are gauged against ASHRAE standards from two years before construction initiation. Partial deductions are also attainable based on project specifics and energy savings. Energy reductions of 10% can still amount to large savings. In the case of lighting upgrades only, you must reduce the energy and power costs of a building by 25%